- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- Personal Finance

Stay Safe, Sell Stocks: Zvi Bodie says retirees should go into conservative overdrive

Emily Brandon

While most financial planners are still extolling the virtues of stocks -- even in the midst of a recession -- Zvi Bodie is telling retirement-age investors to run the other way.

The Boston University and Massachusetts Institute of Technology finance and economics professor, who is coauthor of Worry Free Investing

, says any investor who doesn't have the heart of a high-stakes gambler should pull his or her nest egg out of the stock market and shift retirement money into inflation-protected government bonds.

Continuing to invest retirement money in stocks, according to Bodie, is similar to trying to win money back from a Las Vegas casino. We asked Bodie to explain his conservative investing strategy. Excerpts:

Should ordinary investors with 401(k)'s keep a certain percentage of stocks in their portfolio?

Right now, the conventional advice basically hinges on how old you are.

The two additional factors that I think are way more important than your age are your level of income and wealth and the riskiness of your job.

For most ordinary people during most of their lifetime, the most important asset they have is their earning power. If you have a job that is very secure -- like a tenured professor at a university -- you can sort of look at your human capital as a safe asset.

Assuming you are buying the proper kinds of insurance against disability, then there is nothing wrong with exposing yourself to the risk in the stock market in your investment portfolio.

Isn't it the conventional wisdom right now that retirees should hold some stocks to provide growth and protect against inflation?

That, I think, is about the worst advice you can give people who are retiring if they are people of modest means.

The claim that the only way you can protect yourself against inflation is by investing in the stock market is a lie.

If you want to beat inflation, what you want are TIPS [treasury inflation-protected securities] and I bonds.

Diversification is certainly a valid way to reduce risk, but the only thing that can protect your nest egg is investing in safe assets. As we have seen in the current market, risky assets all tend to go down. What people of modest means need is additional Social Security income.

They need inflation-protected, very secure income that will last as long as they live. [An example is] immediate annuities that are inflation protected.

The rule of thumb is that once you reach retirement, you should only take out 4 percent of your retirement savings every year to live on if you want it to last and be inflation protected. You can get much more than 4 percent, even with inflation protection, if you convert it to an immediate life income annuity. And equities, as we have just seen, are anything but a reliable inflation hedge. If you had your money in equities, you just saw 40 percent of it disappear in one year.

Wouldn't leaving the stock market right now be locking in your losses?

That is exactly right. You want to make sure you don't lose more.

Suppose you thought that equities were going to protect you against inflation in retirement. All of a sudden, you had this rude awakening when you saw 40 percent of your portfolio evaporate before your eyes.

You can draw two conclusions from that. You can say, "Oh, my God, I didn't realize how risky these things are. I am going to switch all my money into something that is safer. I may even have to go back to work part time to make up for what I have lost, but at least I know that what I have is secure."

The other route is "I only have part of what I had before, but I am going to stick it out in the hope that maybe now it will be safer." Which of these two paths seems more rational to you? I view this downturn in the market as a wake-up call to investors to question the conventional wisdom they have been fed over the year by everyone in the investment industry.

It is not true now, and it was never true.

Equities are risky in the short run and in the long run. If you can afford to take that risk, you should take it, but recognize that there is a big downside.

What if you have time to hold stocks over the long term?

The view that stocks are almost safe in the long run is just plain fallacious.

It's been proven many times over that stocks are risky in the long run as well as in the short run.

If it were true that stocks are really safe if you hold them for a long time, then shouldn't the investment company that is trying to convince you to invest in stocks for the long term be willing to offer you a guarantee?

What if I am willing to commit to holding stocks for 25 years?

Will you guarantee me that at the end of 25 years that I will have at least as much as if I had invested in TIPS or some other safe security?

I think you will find that the answer is no unless the company wants to go bankrupt. If it is true, then who should be taking that risk: investment companies or individuals who don't know the first thing about it?

Is it true that you didn't lose a penny in the market downturn?

I have 100 percent of my retirement money invested in treasury inflation-protected securities.

That is not to say I don't hold risky assets. I do have risky assets, but I don't hold them in my retirement portfolio. I segregate my assets into ones I know I can count on to maintain my standard of living in retirement and other assets in which I am willing to take some risks.

My target retirement age is 75. Truthfully, I doubt I will retire at 75 if I am still physically and mentally fit. I enjoy what I do at work.

Many workers with 401(k)'s are automatically enrolled in target-date funds. Are these a good investment?

In my opinion, the vast majority of them are completely misnamed.

Suppose I am planning to retire in 2010. There is the expectation on the part of most people who don't know much about investing that at that target date they will have enough money to retire. The investment industry persuaded ordinary people that all they had to do was sit back while stocks delivered them a comfortable retirement.

Nothing of the sort is true. The only thing that target-date funds do is they automatically lower the percent of retirement assets in the stock market and increase the portion that is in the bond market. Most of them still have you invested with half of your money in the stock market at your retirement date.

The typical 2010 retirement fund lost 30 percent of its value. There is a very low likelihood that those [2010] funds are going to make up that 30 percent loss.

Can someone who makes $40,000 or $50,000 a year get to a secure retirement without taking any risks?

The point is to be setting aside enough income during your working years so you can maintain your standard of living after you are too old to work.

Someone who is making $40,000 or $50,000, unless they have a very modest lifestyle, probably is not going to be able to retire until they can't work anymore. That's the reality.

Anyone who is trying to convince those people that they can retire at age 65 and live comfortably is selling them a dream.

If they really hate their job, then they'd better prepare to make some sacrifices in terms of their standard of living.

So how should workers allocate their retirement money?

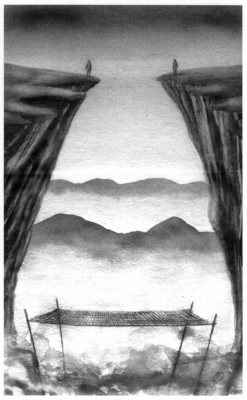

I advocate an investment pyramid.

At the base, you've got your Social Security income and whatever you can continue to earn from employment. Social Security is probably the best investment you can find at later age.

For every year you delay claiming benefits, the starting benefit increases by 8 percent. Try to postpone taking it until you reach age 70.

The next layer is TIPS in an IRA account. TIPS are very safe and very simple and are going to be a good hedge against inflation. And if you have calculated and are confident that you have all your income needs in retirement covered with those safe investments, then take risks.

Available on Amazon.com:

To Stay Safe, Sell Stocks: Zvi Bodie says retirees should go into conservative overdrive

© U.S. News & World Report